Advertisement

-

Published Date

August 23, 2018This ad was originally published on this date and may contain an offer that is no longer valid. To learn more about this business and its most recent offers, click here.

Ad Text

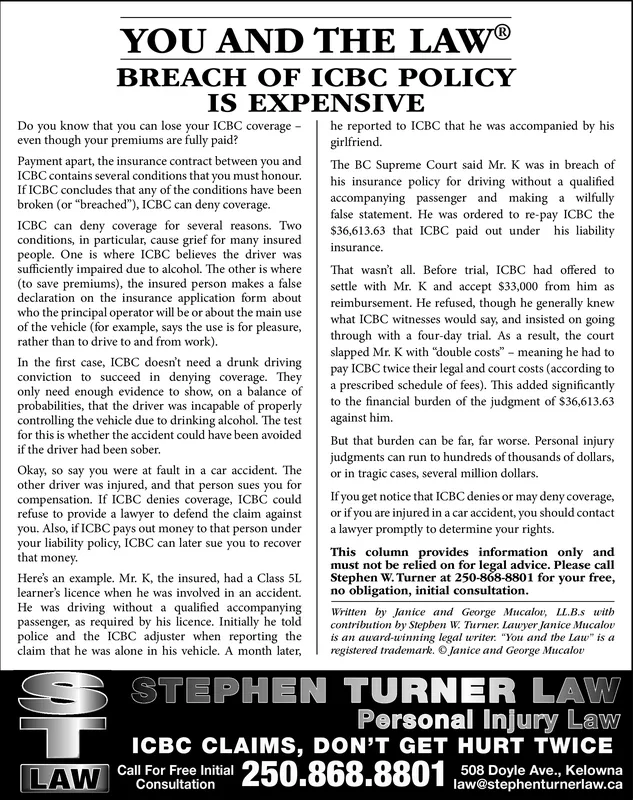

YOU AND THE LAW® BREACH OF ICBC POLICY IS EXPENSIVE Do you know that you can lose your ICBC coverage- he reported to ICBC that he was accompanied by his even though your premiums are fully paid? girlfriend Payment apart, the insurance contract between you and ICBC contains several conditions that you must honour If ICBC concludes that any of the conditions have been broken (or "breached"), ICBC can deny coverage. BC Su his insurance policy for driving without a qualified insurance policy for d ICBC can deny coverage for several reasons. Two conditions, in particular, cause grief for many insured people. One is where ICBC believes the driver was mpanying passenger and making a false statement. He was ordered to re-pay ICBC the 36,613.63 that ICBC paid out under his liability insurance. sufficiently impaired due to alcohol. The other is where That wasn't all. Before ia, ICBC had offered to (to save premiums), the insured person makes a falsesettle with Mr. K and accept $33,000 from him as declaration on the insurance application form about reimbursement. He refused, though he generally knew ho the principal operator will be or about the main use of the vehicle (for example, says the use is for pleasure rather than to drive to and from work) what ICBC witnesses would say, and insisted on going through with a four-day ia. As a result, the court slapped Mr. K with "double costs" meaning he had to pay ICBC twice their legal and court costs (according to a prescribed schedule of fees). This added significantly In the first case, ICBC doesn't need a drunk driving conviction to succeed in denying coverage. The only need enough evidence to show, on a balance of probabilities, that the driver was incapable of properlyo theinanc controlling the vehicle due to drinking alcohol. Theestagainst him. for this is whether the accident could have been avoided if the driver had been sober. burden of the judgment of $36,613.63 But that burden can be far, far worse. Personal injury judgments can run to hundreds of thousands of dollars, or in tragic cases, several million dollars. Okay, so say you were at fault in a car accident. The other driver was injured, and that person sues you for compensation. If ICBC denies coverage, ICB couldIf you get notice that ICBC denies or may deny coverage. refuse to provide a lawyer to defend the claim againstor if you are injured in a car accident, you should contact you. Also, if ICBC pays out money to that person undera lawyer promptly to determine your rights. your liability policy, ICBC can later sue you to recover that money. This column provides information only and must not be relied on for legal advice. Please call Here's an example. Mr. K, the nsured, had a Class 5LStephen W. Turner at 250-868-8801 for your free, learners licence when he was involved in an accin no obligation, initial consultation He was driving without a qualified accompanyingWritten passenge, as require police and the ICBC adjuster when reporting the is an auard-winning legal writer "You and the Law" is a claim that he was alone in his vehicle. A month later, I registered trademark janice and George Micalou by Janice and George Mucalo, L.B.s with d by his licence. Initially he toldcontribution by Stepben W. Turner. Lauyer Janice Mucalov SSTEPHEN TURNER LAW Personal Injury Law ICBC CLAIMS, DON'T GET HURT TWICE Call For Free Initial LAW 508 Doyle Ave., Kelowna law@stephenturnerlaw.ca Consultation